How to evaluate "First Republic Bank's share price plunges 50%"?

Share

The 50% plunge is now a thing of the past (April 25). Today (April 26) First Republic Bank (FRC) fell another 30%, closing at $5.69. Who would have thought that just at the beginning of February this year, its share price was once as high as $150 (the highest in the past year was $171), almost from gold to cabbage.

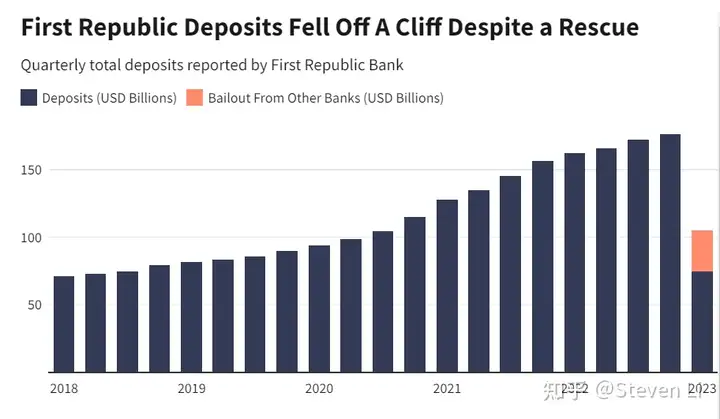

The immediate cause of the precipitous fall in FRC's share price was the precipitous fall in its deposits, which reportedly reached $100 billion. Had it not been for the $30 billion in emergency funding injected into it in March by major banks like JP Morgan Chase, its drop would have been more than 50%. It is evident that its customers are no longer optimistic about its prospects of continuing to operate and have pulled out of the market.

The current situation facing FRC is extremely unpromising. Regulators, including the Federal Reserve, want FRC to reach an asset disposal or acquisition agreement with other banks as soon as possible, even threatening that if such an agreement is not reached as soon as possible, FRC will lose its eligibility for liquidity relief from the federal discount window. This will avoid the use of public funds such as the FDIC's insurance fund to bail it out again. In fact, the subtext is: it is best to save yourself and not expect to spend taxpayer money.

The FRC's management is still making last-ditch attempts, including splitting bank assets into "good banks" and "bad banks" based on quality, with the intention of making the latter's assets available for sale at a premium. The FRC has become a hot potato, but the banks don't seem to be buying it and are taking a wait-and-see attitude. The situation it faces is similar to that of Lehman Brothers in September 2008.

The crisis in the U.S. banking industry is far from seeing the end of the end.